Consumer Protection Unit

If you have a CONSUMER QUESTION or COMPLAINT, CALL US!

- In Hampshire County - (413) 586-9225

- In Franklin County - (413) 774-3186

The Consumer Protection Unit is one of the local consumer programs throughout the Commonwealth working in cooperation with the Massachusetts Attorney General's Office.

A Consumer Protection specialist provides assistance through an informal process involving letters and telephone calls from the consumer and the business, in an effort to reach a mutually agreeable settlement. If Consumer Protection staff members are unable to resolve your complaint, they will discuss the option of redress through small claims court, face-to-face mediation or a private attorney.

Consumer Protection Unit Brochure

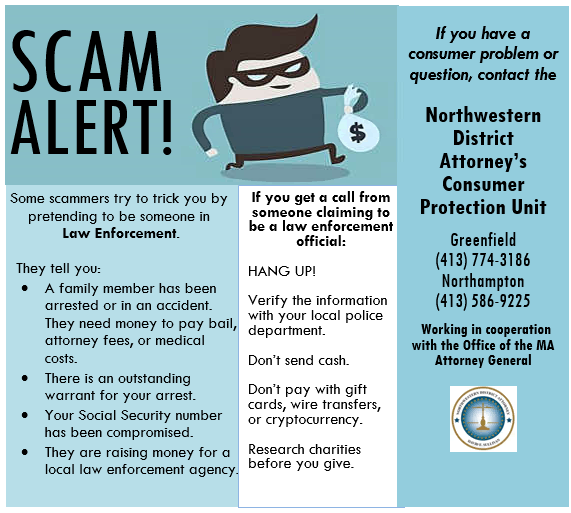

Consumer Scam Sheet

Note: The Consumer Protection Unit does not provide legal advice or opinions.